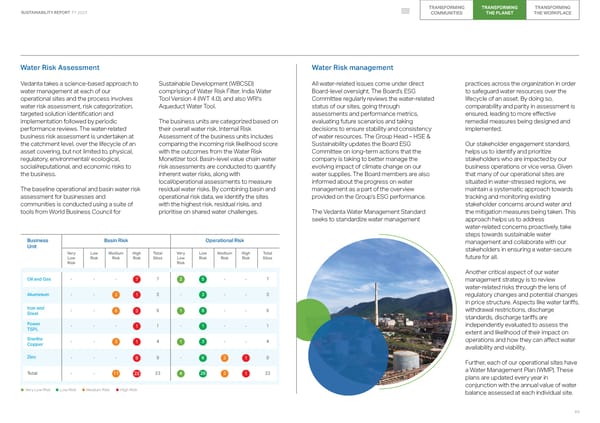

TRANSFORMING TRANSFORMING TRANSFORMING SUSTAINABILITY REPORT FY 2023 COMMUNITIES THE PLANET THE WORKPLACE Water Risk Assessment Water Risk management Vedanta takes a science-based approach to Sustainable Development (WBCSD) All water-related issues come under direct practices across the organization in order water management at each of our comprising of Water Risk Filter, India Water Board-level oversight. The Board’s ESG to safeguard water resources over the operational sites and the process involves Tool Version 4 (IWT 4.0), and also WRI's Committee regularly reviews the water-related lifecycle of an asset. By doing so, water risk assessment, risk categorization, Aqueduct Water Tool. status of our sites, going through comparability and parity in assessment is targeted solution identification and assessments and performance metrics, ensured, leading to more effective implementation followed by periodic The business units are categorized based on evaluating future scenarios and taking remedial measures being designed and performance reviews. The water-related their overall water risk. Internal Risk decisions to ensure stability and consistency implemented. business risk assessment is undertaken at Assessment of the business units includes of water resources. The Group Head – HSE & the catchment level, over the lifecycle of an comparing the incoming risk likelihood score Sustainability updates the Board ESG Our stakeholder engagement standard, asset covering, but not limited to, physical, with the outcomes from the Water Risk Committee on long-term actions that the helps us to identify and prioritize regulatory, environmental/ ecological, Monetizer tool. Basin-level value chain water company is taking to better manage the stakeholders who are impacted by our social/reputational, and economic risks to risk assessments are conducted to quantify evolving impact of climate change on our business operations or vice versa. Given the business. inherent water risks, along with water supplies. The Board members are also that many of our operational sites are local/operational assessments to measure informed about the progress on water situated in water-stressed regions, we The baseline operational and basin water risk residual water risks. By combining basin and management as a part of the overview maintain a systematic approach towards assessment for businesses and operational risk data, we identify the sites provided on the Group’s ESG performance. tracking and monitoring existing communities is conducted using a suite of with the highest risk, residual risks, and stakeholder concerns around water and tools from World Business Council for prioritise on shared water challenges. The Vedanta Water Management Standard the mitigation measures being taken. This seeks to standardize water management approach helps us to address water-related concerns proactively, take steps towards sustainable water Business Basin Risk Operational Risk management and collaborate with our Unit stakeholders in ensuring a water-secure Very Low Medium High Total Very Low Medium High Total future for all. Low Risk Risk Risk Sites Low Risk Risk Risk Sites Risk Risk Another critical aspect of our water Oil and Gas - - - 7 7 2 5 - - 7 management strategy is to review water-related risks through the lens of Aluminium - - 2 1 3 - 3 - - 3 regulatory changes and potential changes in price structure. Aspects like water tariffs, Iron and - - 6 3 9 1 8 - - 9 withdrawal restrictions, discharge Steel standards, discharge tariffs are Power - - - 1 1 - 1 - - 1 independently evaluated to assess the TSPL extent and likelihood of their impact on Sterlite - - 3 1 4 1 3 - - 4 operations and how they can affect water Copper availability and viability. Zinc - - - 9 9 - 6 2 1 9 Further, each of our operational sites have Total - - 11 22 33 4 26 2 1 33 a Water Management Plan (WMP). These plans are updated every year in conjunction with the annual value of water Very Low Risk Low Risk Medium Risk High Risk balance assessed at each individual site. 64

2023 ESG Report Page 63 Page 65

2023 ESG Report Page 63 Page 65