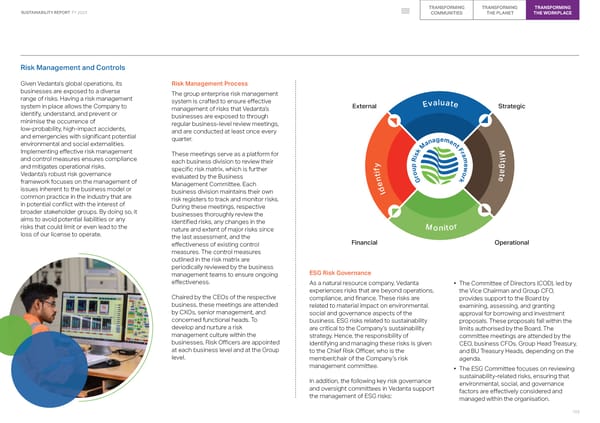

TRANSFORMING TRANSFORMING TRANSFORMING SUSTAINABILITY REPORT FY 2023 COMMUNITIES THE PLANET THE WORKPLACE Risk Management and Controls Given Vedanta’s global operations, its Risk Management Process businesses are exposed to a diverse The group enterprise risk management range of risks. Having a risk management system is crafted to ensure effective valuate system in place allows the Company to management of risks that Vedanta’s External E Strategic identify, understand, and prevent or businesses are exposed to through minimise the occurrence of regular business-level review meetings, low-probability, high-impact accidents, and are conducted at least once every and emergencies with significant potential quarter. ageme environmental and social externalities. an n t M F Implementing effective risk management k r M These meetings serve as a platform for s am i i and control measures ensures compliance each business division to review their R t y e g and mitigates operational risks. specific risk matrix, which is further f i p u o o w t a Vedanta’s robust risk governance evaluated by the Business t n r G k r e framework focuses on the management of Management Committee. Each e d issues inherent to the business model or business division maintains their own I common practice in the industry that are risk registers to track and monitor risks. in potential conflict with the interest of During these meetings, respective broader stakeholder groups. By doing so, it businesses thoroughly review the aims to avoid potential liabilities or any identified risks, any changes in the risks that could limit or even lead to the nature and extent of major risks since Monitor loss of our license to operate. the last assessment, and the effectiveness of existing control Financial Operational measures. The control measures outlined in the risk matrix are periodically reviewed by the business management teams to ensure ongoing ESG Risk Governance effectiveness. As a natural resource company, Vedanta • The Committee of Directors (COD), led by experiences risks that are beyond operations, the Vice Chairman and Group CFO, Chaired by the CEOs of the respective compliance, and finance. These risks are provides support to the Board by business, these meetings are attended related to material impact on environmental, examining, assessing, and granting by CXOs, senior management, and social and governance aspects of the approval for borrowing and investment concerned functional heads. To business. ESG risks related to sustainability proposals. These proposals fall within the develop and nurture a risk are critical to the Company’s sustainability limits authorised by the Board. The management culture within the strategy. Hence, the responsibility of committee meetings are attended by the businesses, Risk Officers are appointed identifying and managing these risks is given CEO, business CFOs, Group Head Treasury, at each business level and at the Group to the Chief Risk Officer, who is the and BU Treasury Heads, depending on the level. member/chair of the Company’s risk agenda. management committee. • The ESG Committee focuses on reviewing In addition, the following key risk governance sustainability-related risks, ensuring that and oversight committees in Vedanta support environmental, social, and governance the management of ESG risks: factors are effectively considered and managed within the organisation. 103

2023 ESG Report Page 102 Page 104

2023 ESG Report Page 102 Page 104